Tourism: when Google searches and Airbnb reviews come to the statistician’s rescue

Essential for France, Tourism is driven by both national and international customers. This activity came to a halt during the first lockdown in March 2020, then fluctuated sharply due to travel’s restrictions. For the tourism sector, as for others, official statistics have evolved and enriched their tools to monitor activity during this period. Taxes and employee data were used to assess the recovery of activity in establishments in spring 2020. However, in order to monitor tourist activity as closely as possible, Insee is now working on privately held data – PHD – such as credit card payments, comments on platforms for booking overnight stays, or even Internet searches.

The health crisis has disrupted tourist activities in France. This blog post presents statistical observation system for tourism, its observations from the period before the health crisis until today, and how it has been adapted and enriched to refine current analysis of tourism.

A general observation stands out: the very important national – or resident – customers in France, has made it possible to absorb the shock of the decline in tourism activity, contrary to what may have happened in countries which are more dependent on international customers.

Measuring tourism in France

The United Nation World Tourism Organization defines Tourism as « a social, cultural and economic phenomenon which entails the movement of people to countries or places outside their usual environment for personal or business/professional purposes ». In France, three statistical systems have been used to measure tourism activity:

- The accommodation supply and tourist attendance in hotels, campsites and other collective accommodation has been measured every month for the past 30 years by the INSEE’s supply survey (EFT in french);

- Travel and resident tourist expenditure, i.e. people living in France wherever they travel in France or abroad, are measured by demand survey (SDT), under the responsibility of INSEE since 2020; 2019 data were recovered and used by INSEE to get pre-crisis reference;

- Attendance of foreign tourists, known as « non-residents », visiting France and their expenditure has been monitored by a foreign survey (EVE), conducted monthly by the Banque de France since 2020.

The first two systems comply with the European regulation on tourism statistics, which provides comparable data for all European Union countries.

Based on the results of these three surveys (EFT, SDT and EVE) and additionnal sources, as the balance of payments of the Banque de France, INSEE produces the tourism satellite account that measures tourism consumption in France.

This measure system of tourist activity has evolved and been enriched during the health crisis.

Before health crisis, tourism was driven by both national and international customers

Before health crisis and throughout the 2010 decade, international clientele in France was one of the largest in the world in terms of tourist’s attendance (DGE, 2018). This was primarily from the United Kingdom, the United States and Germany.

This major position in terms of international tourists did not prevent the national clientele, qualified as « resident », from being in the majority in France before the crisis in terms of attendance. However, these national tourists spent the majority of their nights in secondary dwellings, with family or friends, i.e. in « non-market » accommodation, for personal reasons (vacations, leisure, cultural visits, etc.) and not for professional reasons.

All kind of commercial accommodations have developed in France to meet different kind of tourist demands : hotels, camping sites, tourist residences, vacation villages, youth hostels and private rentals. The French campsites supply has been the most developed in Europe, accounting for approximately 30% of overnight camping stays in the European Union before the crisis.

In addition, France gathered 20% of private rentals in the European Union via Internet platforms in 2019, just behind Spain, according to work by Eurostat in conjunction with four international platforms.

A collapse of tourist attendance, mostly international, with the health crisis

The health crisis has strongly affected the tourism economy. The first lockdown in March 2020 resulted in a collapse of tourist activity, with the complete disappearance of international tourists and an unprecedented drop in tourist activity from inhabitants in France : hotel stays by residents were down 94% in April 2020 compared to April 2019.

The timid increase of tourists attendance, after the first lockdown, has been followed by the return of resident tourists during summer, especially in secondary dwellings, with family or friends, and rather close to home. Tourism expenditure has returned to its summer 2019 level : resident attendance was important in July and August in hotels, as well as in campsites. This summer recovery in tourism was nevertheless short-lived, with a further deterioration in attendance in September 2020 and a collapse from the 2nd lockdown from November. In Q4 2020 and Q1 2021, hotel occupancy were one-third of its usual level.

The crisis not only disrupted activity, it also hampered the usual collection of statistical information from actors, many of whom were closed and thus unable to respond to surveys.

Then, Insee set up a light protocol to take into account the difficulties of companies: the questionnaire was reduced to strict minimum, question about country of residence was suppressed, and certain types of accommodation were no longer surveyed during the most difficult periods : campsites, tourist residences, vacation villages. INSEE used additional sources, such as value added tax return or data on employees from the nominative social declarations to identify closed establishments among the accommodations that did not respond to the lightened survey. Thanks to these sources, we could estimate if establishments were still open or temporarily closed, and to provide a reliable account of the collapse in attendance.

Summer 2021 close to the level of summer 2019

With the lifting of travel restrictions in May 2021, INSEE has stopped the lightened survey and restarted the full tourist supply survey, allowing for more detailed results, particularly by country of origin.

Hotel occupancy increased in 2nd quarter 2021, while remaining far below its pre-crisis level. During the summer, it gradually approached its historically high summer 2019 level.

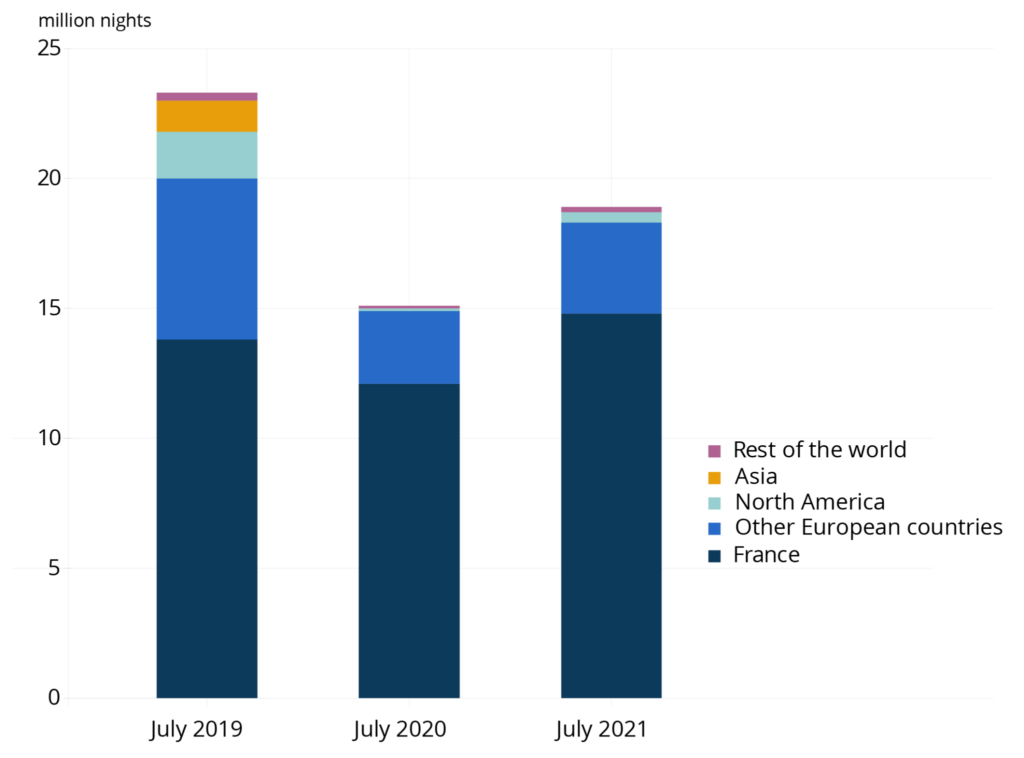

Similarly, attendance at campsites and other tourist accommodations was close to its summer 2019 level. Thus, in May 2021, attendance all kind of tourist accommodations was only half of its May 2019 level. Yet, in August 2021 it was back to 93 percent of its August 2019 level. This recovery of activity was based on the resident clientele. On the other hand, the two main international clients returned very little, from United Kingdom and United States (figure 1).

Figure 1 – Number of overnight stays in hotels in July 2019, 2020, 2021 by tourist’s country

Source: Insee, tourism supply survey.

New difficulties in autumn 2021

Beyond surveys, INSEE’s sales turnover indexes provide a rapid characterization of activity: from July to October 2021, the hotel index returned to a level close to 2019.

Moreover, as the health crisis has disrupted the usual collection systems, including the supply survey EFT, and at the same time increased the need for rapid information, INSEE has invested in the use of PHD. These data do not have the same purpose or scope as data from tourism surveys. Therefore, they’re not directly comparable with them. They are analyzed – above all – in evolution and interpreted with caution.

Thus, during lockdowns, INSEE experimented with the use of mobile phone data, which provided a view of the present population. However, this use was insufficiently detailed to measure tourist overnight stays. Consequently, Insee didn’t disseminate results on tourism with these data. But, INSEE has used three other types of PHD to analyze the tourism sector:

- Resident tourist expenditure, paid by bank card in the middle of summer 2021 is significantly higher than the level measured in 2019 in most french departments, especially in the southern half of the country;

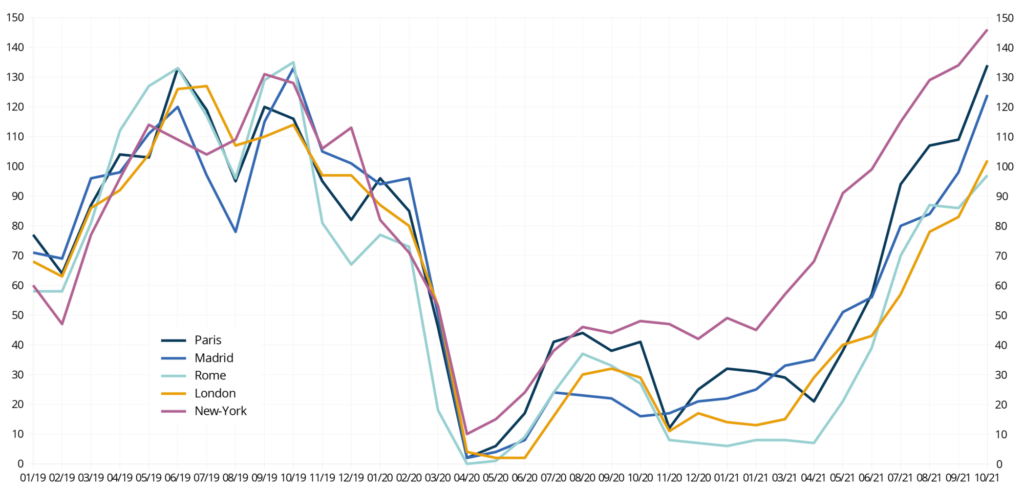

- Information on overnight stays booked via online platform Airbnb can be mobilized, in particular through the data made available by Inside Airbnb. We can follow the number of comments left by users and to compare the situation of major tourist cities such as Paris, Madrid, Rome, London or New-York for example (figure 2). By this measure, Paris looks in a better situation than London or Madrid this summer, before the October 2021 drop, but worse than New York, for which the number of comments has even exceeded the 2019 level.

Figure 2 – Number of comments left on Airbnb, after a stay in Paris, Madrid, Rome, London or New York

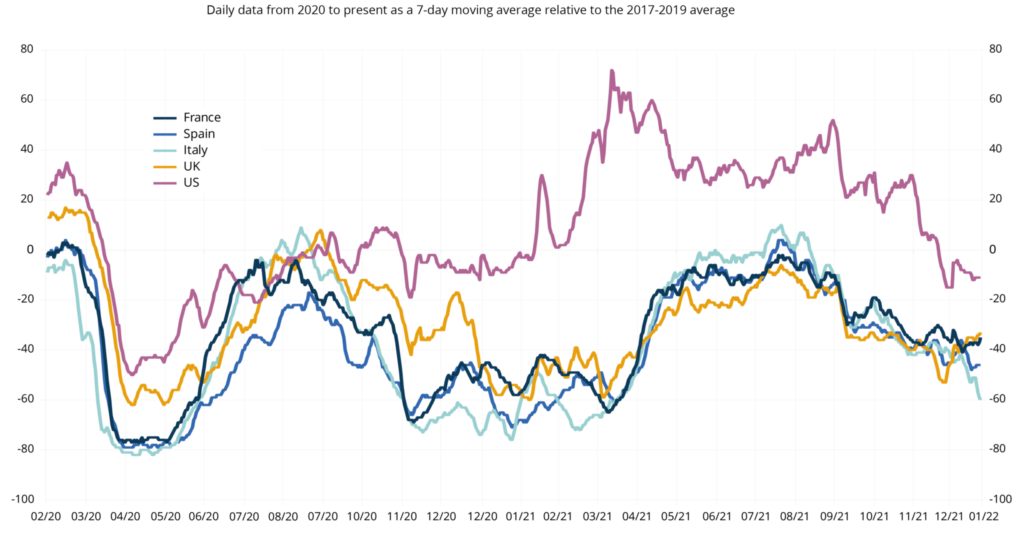

- The statistics of internet searches on the Google, made available by the company on Google Trends, also make it possible to report on major trends and to compare countries. Thus, searches of the word « hotel » quickly returned to their pre-crisis level in the United States, as early as 2020, whereas the recovery was slower in Europe, where it returned to its pre-crises level in 2021’s summer (figure 3). The gap between the U.S. and Europe has remained since 2020, including in the current period, which is characterized by a steady decline in searches.

This decline since October 2021 appears to be slightly less pronounced in France than in Spain, Italy or the United Kingdom. Restrictions on international and internal travel within each country probably explain the variation.

Another factor may have contributed to the widening gap between countries : the importance of the national clientele relative to the international clientele. Tourist travel by residents is about ten times higher in the United States than in France, while overnight stays by international customers is of the same order of magnitude between the two countries.

As a result, travel restrictions between the United States and Europe may have led a number of American tourists to forego travel to Europe in favor of local tourism. The importance of the U.S. resident clientele may have helped to cushion the impact of the crisis by boosting local tourism more quickly. ■

Figure 3 – Number of searches for the word « hotel » in France, Spain, Italy, the UK and the US

Source: Google Trends, calculation Insee.

Additionnal information

- Tourism databases:

- Canonero B., Gidrol J-C. and Mainguené A., 2020, « Decrease of nights spent by tourists in September, after recovering in July-August », Insee Focus, November

- Dangerfield O. and Mainguené A., 2021, « 2020 Tourism Report Fall in attendance in 2020, rebound in the summer, especially in campgrounds », Insee Focus, May

- Dangerfield O. and Mainguené A., 2021, « During the First Quarter of 2021, Hotel attendance was at One Third of its Usual Level », Insee Focus, July

- Dangerfield O. and Mainguené A., 2021, « Hotel occupancy increases in Q2 2021, but remains significantly below its pre-COVID level », Insee Focus, September

- Direction générale des entreprises (DGE), 2019, Compte satellite du tourisme « La croissance de la consommation touristique en France se confirme en 2018 », 4 pages de la DGE, no. 91, December

- Direction générale des entreprises (DGE), 2019, Mémento du tourisme, édition 2018, March

- Eurostat, 2021, « Short-stay accommodation offered via online collaborative economy platforms », Statistics Explained, December

- Gidrol J-C. and Girard P., 2020, « In June 2020, 73% fewer overnight stays in hotels than in 2019 in Metropolitan France », Insee Focus, August

- Insee, Supply survey

- Insee, 2018, « Understanding the Nominative Social Declaration (DSN) for Better Statistical Measurement », Courrier des statistiques N1-2018, December

- Insee, 2021, « Tourism: resident attendance is sustained, but foreign customers are lacking », in Note de conjoncture, October

- Insee, 2022, « Turnover index – Hotels and similar accommodation », Séries chronologiques

- Semecurbe F., Suarez Castillo M., Galiana L., Coudin É. and Poulhes M., 2020, « Que peut faire l’Insee à partir des données de téléphonie mobile ? Mesure de population présente en temps de confinement et statistiques expérimentales », Blog de l’Insee, April

- Ulrich A., 2021, « Accommodations offered by individuals via platforms », Insee première, November